Benefits of Joining Your Local REIA

REIA is an abbreviation for Real Estate Investing Association / Group. REIA groups or clubs as some are called, are an invaluable tool to meet people from all walks of life who have an interest in real estate investing and to learn all about the REI business. Members of REIA groups are like-minded groups of men and women “where deals and funding meet.” Companies have been formed, and deals have been made directly from the relationships developed and information shared at REIA group events. I refer to them as your real estate investor “watering hole.” Members attend the “Watering Hole” to learn and find deals and funding.

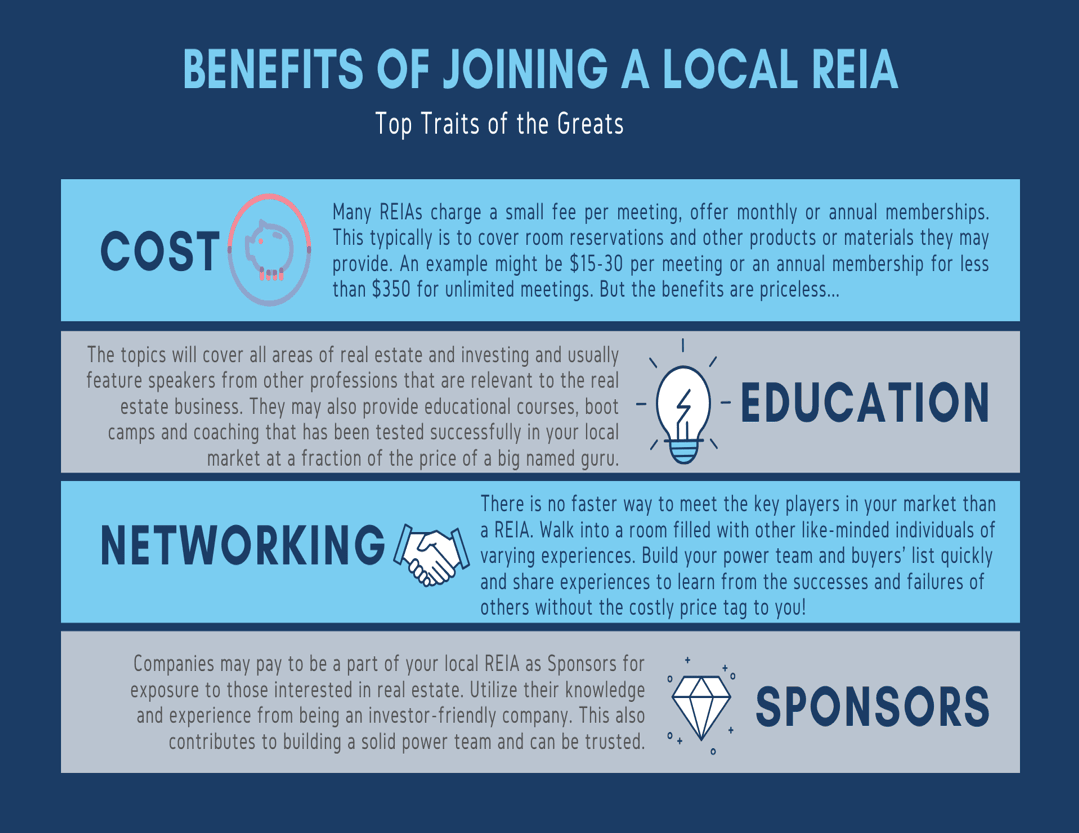

Learn more about the benefits of joining your local REIA group through the Infographic below:

Education - Here's a small list of topics you may see at your local REIA:

+ Getting Started

+ Foreclosures

+ Short Sales

+ Nothing Down Purchases

+ Flipping Properties

+ How to Estimate the After Repaired Value

+ Refurbishing & Rehabbing

+ Lease/Options

+ Finding Bargain Properties

+ Writing Offers

+ Building profitable partnerships

+ Marketing to Find Motivated Sellers

+ Marketing to Sell Your Houses

+ Buying Discounted Notes & Mortgages

+ Mobile Homes & Mobile Home Parks

+ 1031 Exchanges & Other Tax Issues

+ Property Management

+ Using Self-Directed IRAs

+ Lawsuit or Asset Protection & Legal Issues

+ How to Fi ... Read More…